Sorted by date Results 1 - 25 of 74

Every moment seems especially uncertain when you are living it. It is always an illusion. In the shadow of several elections and a couple of wars, with central banks pivoting and equity markets on an unusually long bull run, late 2024 may feel especially dangerous. One way to remember that risk is just the water we swim in is to enumerate and describe our uncertainties. It makes them feel tractable. What follows are my three big questions, and my guesses at their answers. I choose the word...

Social Security is complex, and the details are often misunderstood even by those who are already receiving benefits. It's important to understand some of the basic rules and options and how they might affect your financial future. Full retirement age (FRA) Once you reach full retirement age, you can claim your full Social Security retirement benefit, also called your primary insurance amount or PIA. FRA ranges from 66 to 67, depending on your birth year (see chart). Claiming early The earliest...

On the road to retirement, be on the lookout for hazards that can hamper your progress. Here are five potential risks that can slow you down. Traveling aimlessly Embarking on an adventure without a destination can be exciting, but not when it comes to retirement. Before starting any investing journey, the first step is setting a realistic goal. You'll need to consider a number of factors - your desired lifestyle, salary/income, health, future Social Security benefits, any traditional pension...

The SECURE Act of 2019 dramatically changed the rules governing how IRA and retirement plan assets are distributed to beneficiaries. The new rules, which took effect for account owner deaths occurring in 2020 or later, are an alphabet soup of complicated requirements that could result in big tax bills for many beneficiaries. RMDs and RBDs IRA owners and, in most cases, retirement plan participants must start taking annual required minimum distributions (RMDs) from their non-Roth accounts by...

Investing can be daunting, whether you are experienced or a beginner. Even if you feel confident about your investing strategy, it can be easy to lose focus or make decisions based on emotion. Here are eight quotes from successful investors, economists, and other insightful thinkers that may help provide perspective and focus for your own investing strategy. "The individual investor should act consistently as an investor and not as a speculator."1 – Benjamin Graham, investor, author, and t...

Asset allocation and diversification are so fundamental to portfolio structure that it's easy to lose sight of these strategic tools as you track the performance of specific securities or the dollar value of your investments. It might be worth considering how these strategies relate to each other and to the risk and potential performance of your portfolio. Keep in mind that asset allocation and diversification are methods used to help manage investment risk; they do not guarantee a profit or...

Your most valuable asset may be your ability to earn an income. Over the course of your lifetime, you could earn several million dollars - money that helps support you and your family. If something happened to you, how would your family replace your lost income? Life insurance can help replace your income when needed at your death. However, with the wide variety of policies available, it's important that you understand some of the basic types of life insurance coverage. Term Life Insurance With...

Traditional economic models are based on the premise that people make rational decisions to maximize economic and financial benefits. In reality, most humans don't make decisions like robots. While logic does guide us, feelings and emotions - such as fear, excitement, and a desire to be part of the "in" crowd - are also at work. In recent decades, another school of thought has emerged. This field - known as behavioral economics or behavioral finance - has identified unconscious cognitive biases...

When you hear or read that the market is up or down, what does that really mean? More often than not, it reflects movement in the two best-known stock market indexes, the Dow Jones Industrial Average and the S&P 500. In fact, there are hundreds of indexes that track various categories of investments. While you cannot invest directly in an index, you can buy funds that track specific indexes, and you can look at indexes as a benchmark for certain portions of your portfolio. For example, the Dow...

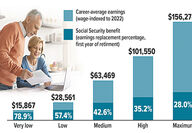

Social Security can play an important role in funding retirement, but it was never intended to be the only source of retirement income. The Social Security benefit formula is based on a worker's 35 highest-earning years (indexed for inflation), and the percentage of pre-retirement income replaced by the benefit is lower for those with higher earnings, reflecting the assumption that higher earners can fund retirement from other sources. Here are replacement rates - based on five levels of...

Couples who have opposite philosophies regarding saving and spending often have trouble finding common ground, and money arguments frequently erupt. But you can learn to work with - and even appreciate - your financial differences. Money habits run deep If you're a saver, you prioritize having money in the bank and investing in your future. You probably hate credit card debt and spend money cautiously. Your spender spouse may seem impulsive, prompting you to think, "Don't you care about our...

Academic researchers have been exploring how investors' personalities might affect their financial decisions and wealth outcomes. In one study, three finance professors (Dr. Zhengyang Jiang from Northwestern University's Kellogg School of Management, Cameron Peng from the London School of Economics, and Hongjun Yan from DePaul University's Driehaus College of Business) surveyed more than 3,000 members of the American Association of Individual Investors - a relatively sophisticated group of...

If you've recently received an inheritance, you may be facing many important decisions. Receiving an inheritance might promote spending without planning, but don't make any hasty decisions. Here are some suggestions that could help you manage your inheritance. Identify a team of trusted professionals Tax laws can be complicated, so you might want to consult with professionals who are familiar with assets that transfer at death. These professionals may include an attorney, an accountant, and a fi...

Real estate investment trusts (REITs) can offer a consistent income stream that is typically higher than Treasury yields and other stock dividends (see chart). A qualified REIT must pay at least 90% of its taxable income each year as shareholder dividends, and unlike many companies, REITs generally do not retain earnings, which is why they provide higher dividend yields than most other stock investments. You can buy shares in individual REITs, just as you might buy shares in any publicly traded...

Here are some things to consider as you weigh potential tax moves before the end of the year. Set aside time to plan Effective planning requires that you have a good understanding of your current tax situation, as well as a reasonable estimate of how your circumstances might change next year. There's a real opportunity for tax savings if you'll be paying taxes at a lower rate in one year than in the other. However, the window for most tax-saving moves closes on December 31, so don't...

Financial worries are often cited as a major source of stress. For example, a 2021 study found that even before the pandemic and subsequent economic downturn, a majority of Americans said they felt stressed or anxious about their finances. Similarly, in 2022, research revealed that more than seven out of 10 financial planning clients experienced financial anxiety more than half the time. What causes financial stress? Lack of assets and/or income is certainly one reason. Another might be the...

A sound retirement plan should be based on your particular circumstances. No one strategy is suitable for everyone. Once you're retired, your income plan should strive to address four basic objectives: earn a reasonable rate of return, manage the risk of loss, maintain a source of sustainable and predictable income, and reduce the impact of taxes. Earn a reasonable rate of return Your retirement savings portfolio will likely be used to provide at least a portion of your income throughout...

In December 2022, Congress passed the SECURE 2.0 Act. It introduced two new rules relating to 529 plans and student debt that will take effect in 2024. The first provision allows for tax- and penalty-free rollovers from a 529 plan to a Roth IRA. The second provision allows student loan payments made by employees to qualify for employer retirement matching contributions. 529 plan to Roth IRA rollover 529 plans are tax-advantaged savings accounts specifically geared to saving for college. In an...

If 2023 has been financially challenging, why not take a moment to reflect on the progress you've made and the setbacks you've faced? Getting into the habit of reviewing your finances midyear may help you keep your financial plan on track while there's still plenty of time left in the year to make adjustments Goal overhaul Rising prices put a dent in your budget. You put off a major purchase you had planned for, such as a home or new vehicle, hoping that inventory would increase and interest...

Municipal bonds are issued by public entities such as state and local governments, health systems, universities, and school districts to help finance the building and maintenance of infrastructure projects such as roads, airports, water systems, and facilities. Despite the higher borrowing costs that resulted from the Federal Reserve's inflation-fighting interest-rate hikes, municipalities issued $308 billion in debt in 2022 to fund capital projects, after selling more than $321 billion in...

The U.S. stock market struggled in 2022, with the S&P 500 index ending the year down more 19.4%.1 The S&P 500, which includes stocks of large U.S. companies, is generally considered representative of the U.S. stock market as a whole, and it is a good benchmark for broad market performance. But there are thousands of smaller companies, and many of those held onto their stock value better during the market conditions of 2022. The S&P MidCap 400, which includes midsize companies, ended the year...

With stock and bond markets both faltering over the past year, it's easy to see why more near-retirees have a newfound appreciation for fixed annuities - insurance contracts that guarantee a specified rate of return. A fixed annuity maintains its value regardless of market conditions, and yields on these products have risen in response to the higher interest-rate environment. When you purchase a fixed annuity, you are shifting the risk for future investment returns to the insurance company....

The U.S. stock market struggled in 2022, with the S&P 500 index ending the year down more 19.4%.1 The S&P 500, which includes stocks of large U.S. companies, is generally considered representative of the U.S. stock market as a whole, and it is a good benchmark for broad market performance. But there are thousands of smaller companies, and many of those held onto their stock value better during the market conditions of 2022. The S&P MidCap 400, which includes midsize companies, ended the year...

The arrival of spring is always a good time to dust off the cobwebs that have built up in your home during the winter. It's also a good time to clean out and organize your financial records so you can quickly locate something if you need it. Keep only what you need If you keep paperwork because you "might need it someday," your home office and file cabinets are likely overflowing and cluttered with nonessential documents. One key to organizing your financial records is to keep only what you abso...

Maintaining an appropriate balance of stocks and bonds is one of the most fundamental concepts in constructing an investment portfolio. Stocks provide greater growth potential with higher risk and relatively low income; bonds tend to be more stable, with modest potential for growth and higher income. Together, they may result in a less volatile portfolio that might not grow as fast as a stock-only portfolio during a rising market, but may not lose as much during a market downturn. Three...