Sorted by date Results 51 - 75 of 616

Credit Unions (CUs) are important for businesses because they generally offer access to lower rates on financing when it comes to major purchases, such as buying equipment or expanding operations. CUs also often have better terms than traditional banks and other financial institutions, allowing businesses to save money in the long run. Additionally, many CUs offer specialized services, such as business financial education. Financial education programs are designed to help business owners...

Losing a spouse is one of the most painful experiences anyone can have. Unfortunately, widows and widowers have to deal with more than just the emotional trauma — they also must consider a range of financial issues. If you’ve recently been widowed, what financial moves should you consider? For starters, don’t rush into any major decisions. If you’re still in the grieving process, you are unlikely to be in the best shape to make significant choices affecting your finances and your life. But onc...

"The kitchen needs to be updated." "We need to build an additional room." "My roof needs to be replaced." "I have too much credit card debt." These are just a few of the comments I hear when a client wants more information on how they can access the equity in their home to make updates or pay off existing debt. Here are just a few of the options that Nations Lending currently can offer to help a client achieve their goal: One option is to consider a cash-out refinance. While there are differing...

A trust will streamline the process of transferring an estate after you die while avoiding a lengthy and potentially costly period of probate (in California if you have assets like a house, and it is worth more than $166,000, there will be a probate in most circumstances). However, if you have minor children, creating a will that names a guardian is critical to protecting both the minors and any inheritance. Deciding between a will or a trust is a personal choice, and some experts recommend...

When you hear or read that the market is up or down, what does that really mean? More often than not, it reflects movement in the two best-known stock market indexes, the Dow Jones Industrial Average and the S&P 500. In fact, there are hundreds of indexes that track various categories of investments. While you cannot invest directly in an index, you can buy funds that track specific indexes, and you can look at indexes as a benchmark for certain portions of your portfolio. For example, the Dow...

Here’s a sobering statistic: 72% of retirees say one of their biggest fears is becoming a burden on their families, according to a study by Edward Jones and the consulting firm Age Wave. If you are near retirement, how can you prepare yourself to become financially free, so you won’t have to depend on grown children or other family members? Here are a few suggestions to consider: • Keep adding to retirement savings. Today, with a greater awareness of healthy lifestyles, many people are spend...

Spring is the ideal time to begin searching for that new home. With the warmer weather and longer days, it is a great time to take advantage of viewing open houses to get a better idea of what type of property will suit your lifestyle and budget. However, the biggest challenge during the spring season of house hunting maybe be getting ahead of other prospective home buyers looking for that perfect home. To be one step ahead of competition, I suggest getting our Nations Lending Accelerated Edge...

Uncertainty has rocked the real estate industry in recent weeks. Since the Sitzer-Burnett verdict, a pending settlement, which must be approved by a judge, will provide a path ahead for real estate professionals and their clients. Instead of relying on a verbal conversation, a written agreement will now be required between a buyer and their real estate broker. This written agreement will be legally binding. It is designed to protect both the client, the broker and the real estate agent. This wri...

Tax-related identity theft occurs when someone uses a taxpayer's stolen Social Security number and name to file a tax return to claim a fraudulent refund. Often the taxpayer doesn't know this has occurred until they try to file a legitimate tax return and have their return rejected with an error code stating that a return has already been filed using that name and Social Security number. This article discusses the steps to take when a taxpayer's identity has been stolen, along with helpful sugge...

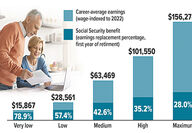

Social Security can play an important role in funding retirement, but it was never intended to be the only source of retirement income. The Social Security benefit formula is based on a worker's 35 highest-earning years (indexed for inflation), and the percentage of pre-retirement income replaced by the benefit is lower for those with higher earnings, reflecting the assumption that higher earners can fund retirement from other sources. Here are replacement rates - based on five levels of...

This is the question most asked when meeting with a potential borrower these days. The steady climb of mortgage rates over the last 3 years has made some borrowers hesitate to purchase, thinking rates will come back down into the 3% range or housing prices will crash. Many economists will agree that to see rates in the 3% range again, it would take a major economic event that we may not wish upon ourselves as rates tend to come down when there's negative economic news. While not a 100%...

One of your important sources of retirement income will likely be Social Security - but when should you start taking it? You can start collecting Social Security benefits at 62, but your checks will be considerably bigger if you wait until your full retirement age, which is likely between 66 and 67. You could even wait until you're 70, at which point the payments will max out, except for yearly cost-of-living adjustments. But if you need the money, you need the money, even if you're just 62 or...

As a business owner, do you mix personal transactions and business transactions? It is a common issue. One survey found that more than one-quarter of small businesses say they co-mingle finances. And it is easy to see why given the wide range of priorities a small business owner oversees every day, using a bank account that is already set up often seems like the easiest and most logical choice. But, while it might seem simpler to only manage one account, that is not actually the case. Here are...

Trusts have been used as an integral part of sophisticated tax and financial arrangements for centuries. Exactly how they are used depends on a person's particular goals, current tax rules, and other factors. Hopefully this article helps you to understand some ways a trust may help you. A trust is an arrangement in which title to property is held by someone for another's benefit. The trust can be established to benefit the person creating it (the grantor), or to benefit another (the...

The real estate market has certainly had its ups and downs in recent years. During the pandemic housing prices soared due to the demand for homes with an extra bedroom or an office. Many people also decided they didn't need to live in a large city anymore because the need to be close to the company office fell away. After mortgage rates hit a 20 year high in 2023, the market quickly slowed. But with the decrease in interest rates from last year, mortgage payments have become more affordable for...

Taxpayers with one or more qualifying children may be able to claim a tax credit of up to $2,000 per qualifying child. The childcare credit is generally a nonrefundable credit that is limited to regular tax liability plus alternative minimum tax liability. However, a portion of the credit is refundable for certain taxpayers. The refundable portion of the additional tax credit for any qualifying child cannot exceed $1,500. The additional childcare credit is the smaller of: 1) The amount of the...

Example: My mother just passed away. She had a living trust. I need to distribute the assets. After the grantor of a living trust dies, there are several things that must be done, either by the successor trustee or the surviving trustee (usually the spouse). The process is called Trust Administration. 1. Obtain several copies of the death certificate. 2. Prepare and record documents that establish the authority of the current trustee. In California, typically you would file an Affidavit Death...

Couples who have opposite philosophies regarding saving and spending often have trouble finding common ground, and money arguments frequently erupt. But you can learn to work with - and even appreciate - your financial differences. Money habits run deep If you're a saver, you prioritize having money in the bank and investing in your future. You probably hate credit card debt and spend money cautiously. Your spender spouse may seem impulsive, prompting you to think, "Don't you care about our...

Benjamin Franklin once said that nothing can be certain, except death and taxes. Well, I am not a funeral director, but I am a mortgage lender and know how you can utilize your tax refund in a home purchase. Saving for a down payment can be a challenging task, with many unexpected expenses occurring along the way. Utilizing your tax return, however, can make that effort much less daunting. You may be able to fund most if not all your down payment depending on the total purchase price of a home...

As your electric bill continues to grow, we can get you a new roof and solar panels for the same monthly price, with back up batteries! That’s right, no more high electric bills, no more peak hours and a new roof that will last 30-50 years, plus solar panels with back up batteries that you own. Zero down and financing as low as 3.99%. Go to www.getsolartoday.energy for your free custom report. Scroll down to click on the three easy steps that will explain the process and how easy it is to save money. Call owner Darren Sauro with Get Solar T...

March 8 is International Women's Day, a day for celebrating all the accomplishments of women around the globe. But many women still need to make up ground in one key area: retirement security. Women's challenges in achieving a secure retirement are due to several factors, including these: • Pay gap – It's smaller than it once was, but a wage gap still exists between men and women. In fact, women earn, on average, about 82 cents for every dollar that men earn, according to the Census Bureau. And...

With a payable on death account or paid on death account, you name a beneficiary who gets the account when you die – no probate, no hassle. The person you name has no rights to the money until you die, so you can spend it all or change the beneficiary whenever you want. A payable on death account is created when you make an agreement with your financial institution – usually your bank. The bank has a formal, legal agreement that lets you tell the bank who they should hand your money over to afte...

Do I need to file a tax return? The answer depends on your filing status, your age and the type of income you earn. Each person is allowed to earn a certain amount of income before they are required to file a tax return. For 2023 tax returns, individuals are not allowed a personal exemption deduction, but are still entitled to a standard deduction of $13,850 for a single file. Hence, an individual can have $13,850 of taxable income before being taxed if under age 65. If age is 65 or over, an...

I get calls all the time from a parent that wants to add their child to their home. Typically this is done to avoid probate. I looked a several articles on the internet and this is what I saw. Adding an adult child to your house deed, or giving them the home outright, might seem like a smart thing to do. It usually isn't. Transferring your house to your kids while you're alive may avoid probate, the court process that otherwise follows death. But gifting a home also can result in a big,...

Academic researchers have been exploring how investors' personalities might affect their financial decisions and wealth outcomes. In one study, three finance professors (Dr. Zhengyang Jiang from Northwestern University's Kellogg School of Management, Cameron Peng from the London School of Economics, and Hongjun Yan from DePaul University's Driehaus College of Business) surveyed more than 3,000 members of the American Association of Individual Investors - a relatively sophisticated group of...